tt

tt

tt

tt

tt

tt

Capitalism

•

Dec 11, 2025

Black Gold and Grey Markets

Adventures in energy trading

Free email newsletter:

Get Arena Magazine in your inbox.

In the Spring of 2020, close to 100 million barrels of oil were stored in tankers on ten square miles of prairie land in Cushing, Oklahoma. Founded by William “Billy Rae” Little, a U.S. government trader for an Indian tribe in 1891, Cushing is a town of about 8,300 people that serves as a critical node in the oil industry.

Cushing is where more than 10,000 miles of Canadian and American pipelines converge. It’s the physical delivery point for West Texas Intermediate (WTI) crude oil, which, alongside Brent, underpins global oil pricing. When WTI futures contracts expire, holders who haven’t closed their positions must take physical delivery of oil at Cushing.

The vast majority of oil traders — over 95%, according to the CME Group, which runs the Chicago Mercantile Exchange — never take delivery of oil. They trade in futures to make money on price changes, but don’t want to deal with the logistics of transporting or storing oil, so they sell contracts before delivery.

The Covid-19 lockdowns broke this system in spectacular fashion.

The lockdowns destroyed global demand for oil, causing prices to collapse dramatically and suddenly. Airlines grounded flights, factories shut down, and commuters stayed home, leading to a historic oversupply. So, rather than sending oil through pipelines to refineries and customers, traders and producers filled storage to capacity at the major trading hubs like Cushing.

At the end of April, with no more room to store oil in Cushing, traders with futures contracts for May delivery were left holding a very large bag, especially those 95% who weren’t actually equipped to take delivery. The result, in simplified terms, was that oil prices went negative. During intra-day trading on April 20th, WTI futures for May delivery hit -$40.32 per barrel. Buyers were being paid to take oil, because the sellers had nowhere to store it. It was the first time that had happened in the history of the WTI futures market.

The five large “trading houses” — Vitol, Glencore, Trafigura, Gunvor, and Mercuria — bought as much oil as they could and stored it on tankers. The traders had control of hundreds of vessels, and were spending a lot of money to control more, including $500,000 a day to lease Very Large Crude Carriers that can hold two million barrels of oil. Vitol alone reportedly booked around 200 million barrels in “floating storage” at its peak which would be enough to meet the entire annual demand of Ukraine.

News of the traders’ activities reached the White House, with President Trump stating at a press conference that “Frankly, ships turned out to be a good business for some people because they're filling up tankers, sending them out to sea, and not saying where to go. They're just sitting out there loaded up with oil.”

The Covid lockdowns created logistical and price dislocations globally and the traders could move their ships to where oil prices were strongest and book profits as the economy recovered. The major commodity traders combined for an estimated $50-60 billion in profit in 2021.

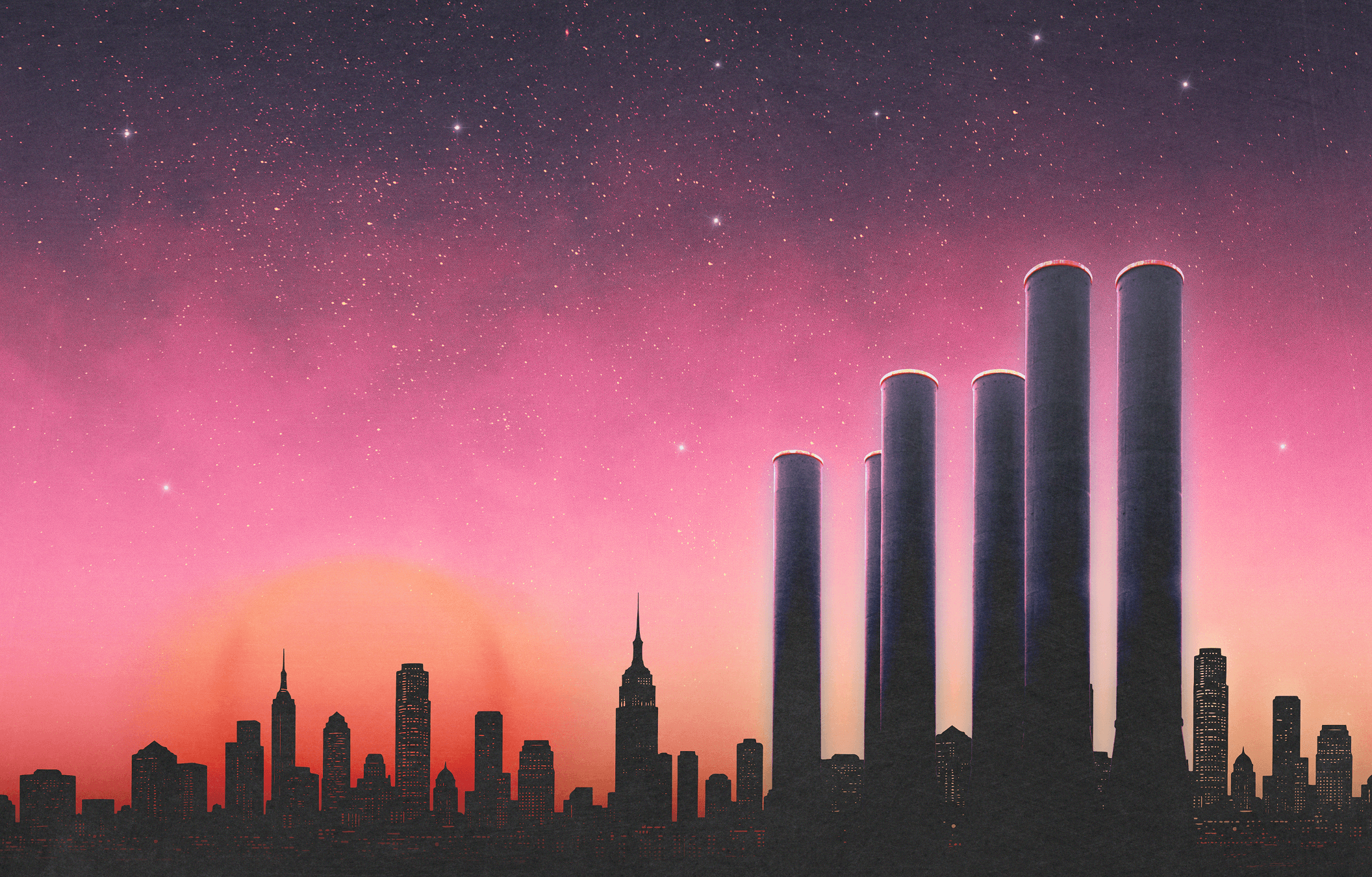

These gains would be eclipsed the following year when the geopolitical fall out of Russia’s invasion of Ukraine sent commodity markets into another panic. European nations, fearing their people would be unable to heat their homes in winter and their economies would crater without Russian oil and gas, aggressively bought alternative supply from traders. A Financial Times analysis showed the commodity trading industry combined for $148 billion in profits in 2022.

A little over 10% of these profits went to Vitol alone, most of which was distributed to the company’s 400 partners. The boom continued into 2023, with the top five houses combining for $1.1 trillion in revenue, with the companies supplying ~24% of global oil supply and controlling 32% of global seaborne oil trade. For perspective, this figure would place the companies behind only China, the U.S., and Germany in a ranking of the world’s largest exporters.

Despite the scale of their operations, few people have heard of the trading houses. This is deliberate. The trading houses are mostly private opaque companies based in Switzerland and do not want their operations scrutinized. The story of how a group of obscure companies came to play such an outsized role in the functioning of the global energy system dates back to the aftermath of World War II when the great powers became locked in a secret war for control of the world’s natural resources.

From West to East

The long economic boom that followed World War II transformed the structure of the global economy. More of every commodity was needed and in massive volumes. Between 1948-1972, oil consumption alone tripled in the U.S., while it increased 15 times in western Europe and 100 times in Japan.

At the same time, Western companies began to lose control of global commodities markets. A cartel of Western companies known as the Seven Sisters — Exxon, Mobil, Chevron, Gulf, Texaco, British Petroleum (BP), and Royal Dutch Shell — had long controlled 85-90% of global oil reserves and production. This led to widespread resentment from resource-rich Third World nations, sparking nationalization movements.

One of the first blows to Western dominance was in Iran, which nationalized the Anglo-Iranian Oil Company in 1951. Mohammed Mossadegh, the Iranian legislator who led the charge, would later become Prime Minister, only to be overthrown by a CIA-MI6 orchestrated coup d’etat dubbed “Operation AJAX.”

Almost fifty African and Asian nations with significant natural resources gained independence in the decades following World War II, many of them from the United Kingdom. The Soviet Union welcomed the opportunity to weaken Western dominance and provided ideological support along with military and technical aid to postcolonial states.

Instead of a Western oligopoly, states no longer under direct Western control controlled the natural resources required for industrial civilization to survive. Because of the importance of their resources, these countries became geopolitical hinge states and pawns on the Cold War chess board.

The conflict played out most frequently through covert actions. When the CIA saw Patrice Lumumba, the first Prime Minister of the Democratic Republic of Congo, as sympathetic towards the Soviet Union, the agency moved to have him killed. The DRC was the largest supplier of uranium to the U.S. nuclear program and the U.S. could not risk losing this supply. The CIA first sent Sidney Gottlieb, a CIA scientist who had previously researched mind control, to poison Lumumba in 1960; it then drafted the plan which led to Lumumba’s capture by DRC secessionists and Belgian military officers and mercenaries the following year. Lumumba was tortured, executed by a firing squad, had his body dismembered and dissolved by acid, and his remains hidden to prevent his grave from becoming a rallying point.

While East versus West spy games played out, political and economic warfare was constant with countries subjected to trade restrictions, embargos, and sanctions. The combination of exploding natural resource demand and the loss of control over these markets by Western companies created the conditions for a new type of company to emerge. A company that could serve as intermediary between the blocs and make large profits in the process.

One of the first to realize this opportunity was Ludwig Jesselson, a German-born refugee who worked at Philipp Brothers, known as PhilBro, a 50-person metals dealer in New York. Under Jesselon’s leadership, PhilBro would deal with any country if there was a profit to be had. As a PhilBro trader put it “One of the basic rules of Phillip Brothers is that business is supreme; politics are not business.” This made PhilBro a very unique firm.

Jesselon traveled the world, securing contracts with regimes other Western companies deemed untouchable. His first big break came in 1946, when Jesselson visited Yugoslavia and left with a contract to sell the entire metals output of Jugometal, Yugoslavia’s state metals monopoly. PhilBro soon had offices across the globe and within a decade was the largest metal trader in the world.

This global reach provided PhilBro the information edge it could use to exploit arbitrage opportunities. PhilBro relied on a network of informants at ports, within governments, and at state-owned exporters and shipping businesses. Bribes were a routine cost of business. This inside information was rapidly disseminated to PhilBro traders around the world through private telex lines. PhilBro executives bragged their telecommunications system was the most sophisticated in the world outside of the CIA and the Pentagon.

The CIA itself paid regular visits to PhilBro’s offices in New York to extract the inside information the company had obtained about the inner workings of the global economy. There are claims that PhilBro’s relationship with the CIA ran much deeper, but what has been confirmed is that the CIA routinely used commodities businesses as fronts and covert partners.

In the early 1960’s the CIA was developing a secret spy plane, dubbed “Archangel”, that was so fast it could outrun any missile. The plane, which would become the SR-71 Blackbird, was designed to fly 85,000 feet in the air at a cruising speed of Mach 3.2. This speed would cause the plane’s skin to reach temperatures of over 500°F, which would deform any conventional airframe. The plane’s designers came upon the novel solution of making the Archangel out of titanium, which is stronger and lighter than steel, and has a melting point of over 3,000°F.

There was just one problem — the largest producer of titanium ore at the time was the Soviet Union and openly buying tonnes of high-grade titanium was impossible.The CIA had to create front companies to acquire the titanium through Western trading companies and other intermediaries.

While the U.S. was forced to leverage its power and use subterfuge to obtain critical metals such as uranium and titanium, its dominance over the most important commodity of all — oil — remained secure. The U.S. was, as the Cold War started, the world’s largest oil producer. To ensure a stable supply of oil, Roosevelt organized a strategic alliance with Saudi Arabia, then led by the founding King Ibn Saud, signed aboard a U.S. Navy cruiser in the Suez Canal during the final months of World War II.

This started to change in 1970, when the U.S. ceded its role as the global swing oil producer to Saudi Arabia. In 1971, the U.S. ended the dollar’s gold convertibility, allowing it to be devalued freely against gold and other currencies. Oil transactions around the world all happened in USD, so the devaluation of the dollar affected the purchasing power of the Gulf States in a meaningful way. Dissatisfied with the economic losses and Western for support for Israel in the Yom Kippur War, the Saudis led the OPEC oil embargo of 1973. As part of the negotiations to end the embargo, Saudi Arabia purchased a 25% stake in Aramco, the U.S.-controlled joint venture that had long monopolized the Saudi’s oil industry. By the end of the decade, the Gulf Arab states had completely nationalized their oil industries and the Seven Sisters (Shell, BP, Texaco, and the Standard Oil scions) controlled less than 10% of global oil reserves.

The changes meant oil supply, the greatest economic prize in history, was now open with the oil industry becoming a free-for-all. Traders who could master the game of oil trading could get very rich.

The Game

Arguably the best to ever play the oil game was a PhilBro trader named Marc Rich. An NYU dropout, Rich joined Jesselson’s PhilBro as a trainee in 1954 at age 19. Worldly and fluent in multiple languages, Rich quickly became a star at the firm and was dispatched across the globe to close deals and solve problems. After the Cuban revolution, he was one of the first Westerners to arrive in Havana to negotiate contracts with Fidel Castro’s government.

A competitor would later say of Rich that “the secret of success in this business is to spot trends…Marc Rich spots trends quicker than anyone I know.” Rich would become the firm’s top oil trader and seized upon the idea that “oil is just another form of money.” That is, oil is merely a liquid store of value that can be traded like any other.

Oil had previously been regarded strictly as an industrial supply that was sold through long-term contracts. Rich pioneered the ‘spot market’ — buying and selling oil for immediate delivery. This novel arrangement allowed Rich, working closely with his associate Pincus “Pinky” Green (nicknamed the Admiral for his mastery of shipping) to make a profit by buying oil wherever it was cheapest and shipping it to wherever it was most profitable.

The cornerstone of Rich’s trading strategy became the 158-mile Trans-Israel Pipeline, abbreviated as Tipline, built in 1968 with covert support from the Imperial State of Iran. From 1967-1975, the Suez Canal was shut down following the Six-Day War between Israel and Egypt, Jordan, and Syria. This meant Iranian oil had to be shipped at high cost nearly 14,000 miles around South Africa’s Cape of Good Hope to reach European markets. The pipeline allowed Iran to bypass the Suez completely, but no one wanted to buy oil transported across Israel in fear of angering the Arab oil powers.

No one, that is, except Marc Rich. Rich and Green had been courting the most powerful people in Iran for years, including sending bribes of $125,000 per awarded oil contract to officials at the National Iranian Oil Company. Serving as an intermediary between Israel and Iran, Rich facilitated a complex scheme where Iranian ships would depart under a false manifest to Israel where its oil would be sent via Tipline to a Mediterranean port and then depart under secrecy to Europe.

Tipline proved especially lucrative during the 1973 oil crises, with Rich and Green using it to make record profits. Despite their performance, PhilBro’s CEO turned down Rich’s request for a $1 million bonus to be split between Green and himself, causing Rich to leave the firm and start a competitor, Marc Rich + Co. in 1974. Rich’s new venture was immediately profitable and by its third year in operation it earned $200 million in profit, exceeding PhilBro.

The profits generated by Rich attracted fierce competition, with a Dutch trader named John Deuss emerging as Rich’s primary rival. Based in a Bahamas villa, Deuss surrounded himself with beautiful female assistants and a large security detail. He traveled the world on his Gulfstream jet, securing deals with the most notorious Third World leaders.

Helping Deuss navigate the geopolitical landscape was ex-CIA agent Ted Shackley, who was nicknamed the “Blond Ghost.” Shackley was formerly second in command of the CIA’s covert operations. Prior to taking that role he had served as the CIA’s Miami station chief leading psychological warfare and sabotage operations in Cuba at the height of the Cuban Missile Crisis, before serving as CIA station chief in Saigon, where he was involved in the Operation Phoenix assassination program that “neutralized” 20,000 people between 1968 and1972.

Deuss was the primary client of Shackley’s company, Research Associates International (RAI), which served as an intermediary and helped deploy tactics such as false flags and mid-sea cargo transfers to help evade embargos. Beyond Shackley, Deuss was linked to a network of former CIA agents who would later be implicated in the Iran-Contra affair, Libyan arms deals, and murder-for-hire plots.

Rich had his own connections to the intelligence world - he was an asset of the Israeli Mossad. After the 1973 Yom Kippur War, Arab oil producers imposed embargos on Israel that threatened to economically strangle the country. Marc Rich’s newly-formed company became critical to Israel’s survival by buying oil from Arab nations and others and secretly selling it to Israel. Over time, Rich “befriended and gained unlimited access to all Israeli prime ministers” and became a power player in the country.

Rich leveraged his contacts in Third World countries to facilitate rescues of imperiled Jewish communities, including “Operation Moses” in 1984 to rescue Ethiopian Jews. Per Israeli journalists, Rich financed “numerous covert missions” on Mossad’s behalf and let Mossad operatives use his offices and business cover to gather intelligence and recruit assets. He also hired Avner Azulay, a retired high-ranking Mossad officer to serve as his security chief and non-profit foundation director.

When the 1979 Iranian Revolution toppled the Shah, Israel lost its primary supplier as did apartheid-era South Africa, which had depended on Iran for 80% of its petroleum. Rich facilitated a secret agreement, covertly supplying South Africa with oil as well as transporting oil from South Africa to Israel. Oil would be shipped via secret tankers where they would be offloaded for shipment through Tipline under fake documentation or in offshore transfers. In exchange, Israel provided an array of weaponry including missiles, rockets, fighter jets, electronic warfare systems, and some of the first military drones.

This trading continued despite U.S. sanctions on Iran, which had caused a global oil market disruption that Rich was able to fully exploit. Marc Rich + Co. earned $1 billion in profits in 1979, which would rank his company — which only had around 100 employees — amongst the ten most profitable in the U.S.

The company would continue to benefit from subverting U.S. sanctions, facilitating Iranian oil trading throughout the 1980-1988 Iran-Iraq War and using the profits to entrench its position in the commodities industry. The company would finance entire governments to secure natural resource rights. A former U.S. official stated “(Rich) virtually hijacked Jamaica’s economy” by providing $1 billion in funding to its government over many years, including paying for the country to send a bobsled team to the 1988 Winter Olympics.

Marc Rich became known as the “King of Oil” as his firm controlled around 13% of global seaborne oil flows at its peak. An estimated 50% or more of company profits was derived from the Iran and South Africa trading. This money funded a lavish lifestyle. Company parties were cocaine-fueled bacchanalias where luxury sports cars were given out as gifts. Rich bought a yacht and became a serious art collector, purchasing works by Picasso, Monet, Miró, Rothko, and Bacon.

The fact that one of the most profitable businesses in the U.S. could fairly be described as a Mossad intelligence operation that was making most of its money by flouting U.S. sanctions did not go unnoticed. In 1984, an ambitious young U.S. attorney named Rudy Giuliani led a prosecution against Marc Rich, indicting him with 65 charges ranging from tax evasion to trading with the enemy.

Facing a 300-year sentence, Rich’s legal team, led by Jack Quinn, former White House counsel, proposed a deal to the FBI and CIA: Rich would share his insider knowledge or assist U.S. intelligence, in exchange for the charges against him being dropped. When the FBI and CIA declined his offer, Rich fled to Switzerland where he remained a trading powerhouse, despite his slot on the FBI’s most-wanted list.

In exile, Rich became a pillar of Zurich society and evaded several near captures facilitated by U.S. intelligence. It was revealed in the Justice Department’s case against Rich that he had covertly obtained a 50% stake in the movie studio 20th Century Fox and he remained engaged in the movie business from Switzerland. He funded the production company New Regency, which was led by Arnon Milcha, a former Israeli intelligence operative who had helped the country secure nuclear triggers. New Regency would go on to produce a series of iconic 1990’s films, including LA Confidential, Fight Club, Pretty Woman, and Heat.

At the same time his movie investments were thriving, Rich divorced his wife Denise, herself a Grammy-nominated songwriter for Celine Dion and Aretha Franklin. The move was rumored to have been done to shield Denise from his legal issues. After the divorce, Denise started showing interest in politics and donated millions to the Democratic National Committee, Hillary Clinton’s 2000 U.S. Senate campaign, Bill Clinton’s legal defense fund, and the Clinton Presidential Library Fund. Her donations and an intense Israeli lobbying effort helped convince Clinton to pardon Rich in 2001. It was one of Rich’s most impressive trades.

To escape the stain on its reputation, senior managers bought Rich’s stake in his business in 1993 and renamed it Glencore. Traders who had worked under Rich went on to start Trafigura and Gunvor, which, along with Glencore, became three of the five largest trading houses in the world. All shared the same core DNA: comfort with risk, speed and information, and a willingness to operate where others wouldn’t. The culture of the modern commodities trading industry, not any one company, is Rich’s legacy.

But their ability to play the games Marc Rich perfected has gotten harder. Glencore was forced to pay $1.1 billion in fines to the U.S., U.K., and Brazil for market manipulation and bribery in 2022 while Trafigura’s COO was sentenced to prison earlier this year in Switzerland for bribing African officials. This is notable because Switzerland has historically been so accommodating that the trading houses used to be able to deduct bribes as business expenses.

The information edge enjoyed by the trading houses has also steadily eroded. This dates back to at least 1981, when PhilBro acquired the investment bank Salomon Brothers, which was famously described as being dominated by “big swinging dick” traders in the book Liar’s Poker. When Salomon Brothers partner Michael Bloomberg was let go, he used his $10 million severance to found his eponymous information service, which provides its customers with pricing data only the established trading houses used to possess.

The trading houses’ last great information edge came from ownership of physical infrastructure, such as tankers and storage terminals. But hedge funds now use satellites equipped with infrared imaging to monitor oil storage levels and ship movements. Some funds, such as Ken Griffin’s Citadel, have nation-state level weather modeling teams that use supercomputers to run forecasts and determine weather impacts on energy supply and demand. All of these tools are additive to the ocean of market data now available for funds to model and create algorithmic trading strategies. No trader can simply use his intuition to spot trends better than the machines employed by the hedge funds.

Perhaps the biggest change in the competitive dynamics for the trading houses has been the emergence of China. Not only is it by far the biggest commodities market, its traders do not have to fear U.S. sanctions or prosecution. The U.S. attempted to sanction a Chinese trader nicknamed Crazy Yang for dealing in Iran multiple times to no avail. A hard drinker who wore a green Army jacket everywhere he went, Yang liked to bear hug business partners and tell them stories about his time in mental institutions. His eccentricities did not prevent him from becoming the world’s largest handler of Iranian crude oil before he died of cancer at age 62 in 2014.

New frontiers are opening in the grey markets of energy. Trading houses of unclear ownership set up shop in Dubai immediately after the Ukraine war began, collectively moving billions of dollars of Russian crude a month. Some curiously had directors with ties to the big five trading houses listed on their corporate registrations. Russian intelligence services have facilitated a “ghost fleet” of ships to keep Russian oil flowing to non-Western buyers and Hong Kong has emerged as a major trading hub of Russian oil and gas. Traders continue to look for an edge, petro states continue to evade sanctions, and old habits die hard.

About the Author

Brian Balkus is a senior director of strategy at a power construction company. He can be found on X at: @bbalkus.