tt

tt

tt

tt

tt

tt

Capitalism

•

Dec 8, 2025

The Great Eighties Wall Street Bonanza

Misremembered excerpts from the start of modern investing

Free email newsletter:

Get Arena Magazine in your inbox.

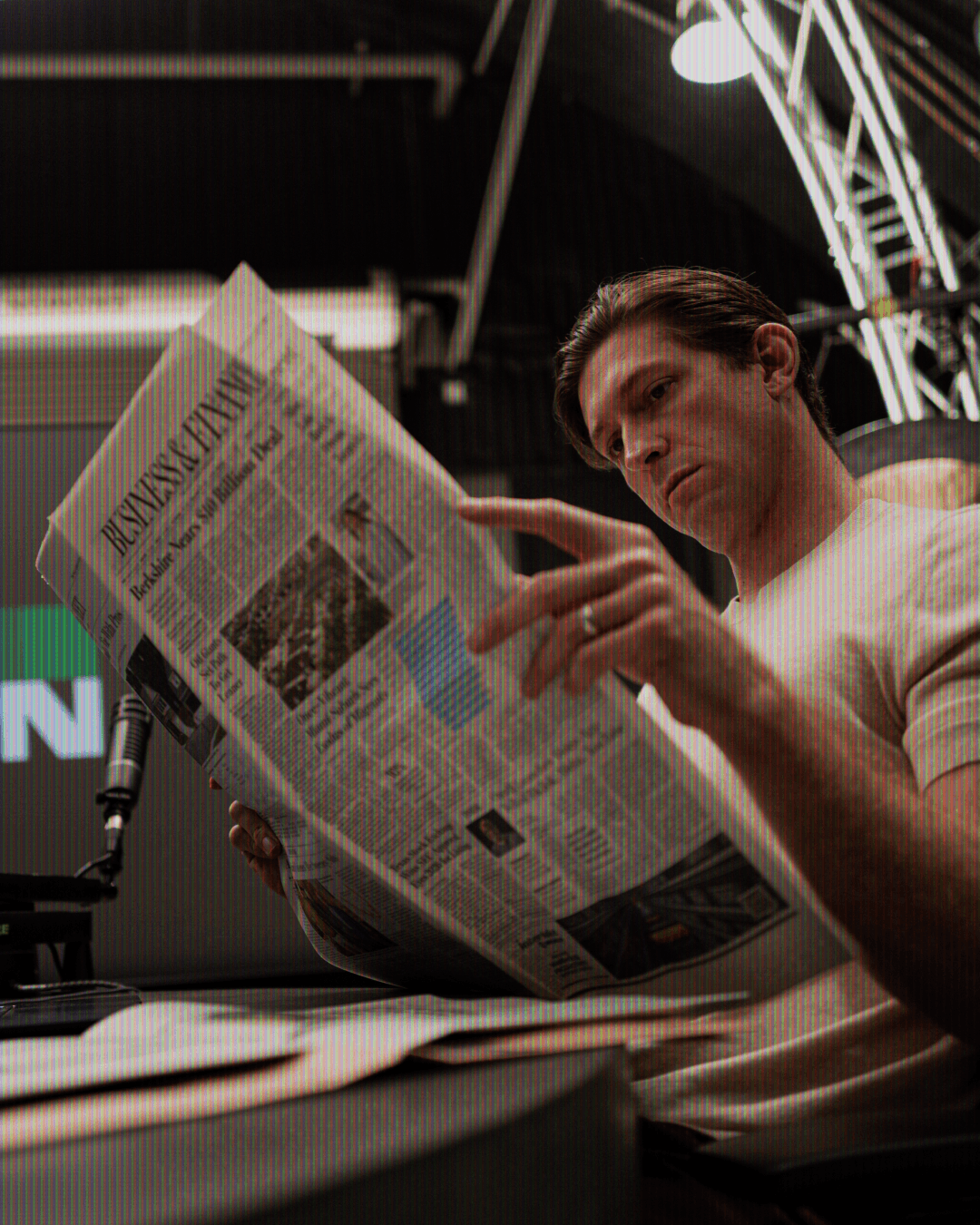

“It was a vast space, perhaps sixty by eighty feet, but with the same eight-foot ceiling bearing down on your head. It was an oppressive space with a ferocious glare, writhing silhouettes, and the roar…The writhing silhouettes were the arms and torsos of young men, few of them older than forty. They had their suit jackets off. They were moving about in an agitated manner and sweating early in the morning and shouting, which created the roar…The room was like a newspaper city room in that there were no partitions and no signs of visible rank. Everyone sat at light gray metal desks in front of veal-colored computer terminals with black screens. Rows of green-diode letters and numbers came skidding across.”

Thus Tom Wolfe in Bonfire of the Vanities (1987) described a Wall Street trading room.

The images of Wall Street in the eighties are forever engraved on the public consciousness. Besides the young men screaming at trading desks, there is the executive with his car phone in the back seat of a black stretch limousine flying through Manhattan’s streets; a corporate raider with slick-backed hair and suspenders over a striped shirt pontificating while staring out of the plate glass window; exultant brokers running around the New York Stock Exchange floor surrounded by crumpled order sheets. The images convey ambition and excitement in equal measure.

Yet for all the drama, people still misunderstand the great investment boom of that era. That run came after an unprecedentedly bad decade for the stock market and New York City. Instead of defining the “eighties,” the boom was really a five-year run, from 1982 to 1987. And far from defining a “decade of greed” that met its comeuppance, the glowing success of the market in that period planted the seeds for decades of triumphant American stock returns. Wall Street in the eighties became a symbol of raw, unrestrained capitalism, which it was. It was also a symbol of capitalism at its best.

What we now think of as the eighties almost started in the seventies. On November 14, 1972, soon after the reelection of the seemingly market-friendly Richard Nixon, the Dow Jones Industrial average finished over 1,000 for the first time. The New York Times reported that “Confetti fluttered, champagne corks popped and stock brokers cheered.” The “Nifty Fifty,” as the blue-chip stocks such Gillette, Dow Chemical, and Eastman Kodak were known, seemed to be on a permanent tear. Economists wondered why, despite the highs, the stock market lagged what they saw as the strong growth in the rest of the economy, and they expected the boom to continue. To some, Dow 1,000 seemed to end the pall the Great Crash of 1929 and the subsequent Great Depression had cast over the market.

Yet what happened to stocks in the decade after 1972 made the Great Depression look good by comparison. If you had invested $100 in the S&P 500 at the beginning of 1929, and reinvested all of the dividends, you would still have $90 in ten years. But that was an era of deflation, so the real value of your stocks would actually end up by about ten percent. By contrast, if you had invested that $100 in the stock market at the beginning of 1972, by July 1982 your nominal investment would have gone up a bit. But this was the era of inflation, so in real terms you would only have a little over $70. The post-tax return for investors was even worse, because capital gains and dividend taxes would be taken out of what the government considered the investors’ “gains,” which in reality were the result of depreciating paper. The seventies were devastating for investors in stocks and bonds.

The main reason for the bad times was simple: inflation, which had been marching upwards by 1972, exploded soon afterwards and, when combined with the high taxes of the period, put a damper on investment. But other shocks hit the market. Nixon and the Republicans came a cropper in Watergate, even as they conceded to ever more activist government policies. New York City, still the global center of stocks and bonds, itself teetered on the edge of bankruptcy, and the Street had to eat losses from the state and city’s questionable municipal bonds.

Like many hard times, the seventies forced reforms that would pay off later. On “May Day” 1975, the New York Stock Exchange ended fixed commissions that had kept trading expensive and exclusive. In 1978 the federal government tweaked its “prudent man” rule, giving pension trustees more power to invest in risky stocks and bonds and private equity. The same year, the Financial Accounting Standards Board made dramatic changes in accounting standards, which allowed outside analysts a better look at the true value of public companies.

The chaotic financial markets of the era also led to financial innovation, which would pay off in the following decade. Here the city of Chicago took a surprising lead from down at-the-heels New York. Fischer Black, then of the University of Chicago, became co-inventor of the Black-Scholes formula for pricing options, and was an early one to see a future in which derivatives were an essential part of investment. He presciently noted: “[A] long term corporate bond could actually be sold to three separate persons. One would supply the money for the bond; one would bear the interest rate risk; and one would bear the risk of default.” In 1973 the new Chicago Board of Options Exchange opened and allowed general trading of stock and bond options. Richard Sandors, the economist who invented the word “derivatives,” helped design the first interest-rate futures. The Chicago Mercantile Exchange struck a deal with Standards and Poors to issue a stock index futures contract.

Most importantly for the coming boom, the Fed finally got serious about fighting inflation. In October 1979, the lanky, cigar-smoking Federal Reserve chair Paul Volcker announced to the world that the Fed was going to start restricting the money supply and that it would allow interest rates to rise. At first, the Fed’s anti-inflation fight imposed immense costs for the country in general, and for New York City in particular. Peter Sternlight was the manager of the Open Market Desk at the Federal Reserve in the early 1980s, so he bought and sold bonds on orders from the Fed’s chiefs. He lived in Brooklyn, which was then filled with empty husks of buildings that couldn’t be refinanced or maintained and the closed shops that came from high interest rates and high unemployment. He knew that he and his colleagues were scribbling little numbers on pieces of paper, entering a few digits in a computer, and that, through a circuitous process, that caused some buildings in Brooklyn to burn down: “I ride my bike through these neighborhoods on Sundays and I ask myself: ‘What the hell are we doing to these areas?” He told himself that “They’ll probably be better off in the long run if we do something about inflation. But I continue to be bothered.” Volcker endured death threats and abuse, but it was his and his colleagues’ work restricting inflation, after a painful three-year period, that allowed the later boom.

The other man most responsible for the boom, and who is still associated with it today, was that unapologetic apologist for capitalism, President Ronald Reagan. It helped that he had some experienced Wall Streeters by his side. For the first four years of his presidency, the former CEO of Merrill Lynch and former vice chair of the NYSE, Donald Regan (whose name caused writers and commentators endless confusion with his boss) was the Treasury Secretary. He had helped Merrill Lynch go public in the early 1970s and had helped with numerous 1970s-era Wall Street reforms. William Casey, who as director of the CIA shipped arms to the Afghan mullahs, had mastered dissimulation from his time as a Wall Street tax attorney, where, according to one report, he had “invented the tax shelter.” He also became chair of the NYSE and pushed for the changes in accounting standards. John Shad was tapped to head the all-important Securities and Exchange Commission. He was formerly vice chair of E.F. Hutton and the first former Wall Streeter to head the commission in half a century.

Although Reagan assumed power in the midst of an economic crisis that would continue deepening during his early years in office and which weighed on stocks and bonds, his administration tried to assure investors. The SEC backed off of excessive involvement in corporate decision making, and Shad actively cheered on the new corporate raiders who bought up sclerotic companies. The relaxed merger requirements from the Department of Justice’s Antitrust Division allowed new combinations to take place without Washington intrusion. The greatest contribution to the boom was the Economic Recovery Tax Act of 1981, which was helped over the finish line by the goodwill Reagan garnered after he was shot. The act cut income tax rates from 70 percent to 50, capital gains rates from 28 percent to 20, and indexed tax brackets to inflation.

But the combination of continued high interest rates and spending cuts meant the economy continued in recession. Volcker and Reagan had to grit their teeth and hope feast would follow famine.

When the stock market bottomed out in August 1982 the country was in a conservative mood. The number one song in America was “Eye of the Tiger” by Survivor, a paean to the “thrill of the fight” and pitiless triumph, without a cause beyond success. The song was better known as the background to Rocky III, the third time Sylvester Stallone portrayed a white working-class hero taking on a showboating black boxer. The number one movie was E.T., whose main villains were U.S. government agents caging something they didn’t understand. The number one fictional TV show in America was Dallas, featuring loving images of oil-fueled luxury, wealth, and sex. Despite the hard times, America was sick of the government involving itself in their business and they wanted to win and get rich.

On August 15, 1982 the New York Times published “Dark Days on Wall Street,” where they noted “[t]he consensus is that the market is in for a tailspin” and that people “are drawing parallels between current happenings and those just prior to the Great Depression.” To most of the American public it didn’t matter though, because “the public has largely withdrawn from the market.”

But that Times article, in classic fashion, hit right at the nadir. Just three days later it became clear that the Fed felt it had finally squelched inflation and that it could start increasing the money supply and reducing interest rates. The Dow saw an all-time record advance, and one of the biggest booms in Wall Street history was off. After the November 1982 elections, when, as the Times reported, “the Democrats failed, despite a 10-percent-plus unemployment rate, to break decisively Mr. Reagan’s hold on Congress” people realized the Reagan revolution was not a passing phase. Now “investors in long-despised stocks and bonds are smiling again and talking about the possibility of sustained good times… The market optimism appears based on what analysts regard as fundamental improvements in the way Washington approaches economic policymaking.” Volcker and Reagan together had endured the hard times, and now they would reap the fruits.

Reagan later went to the NYSE rostrum to ring the morning trade bell. Reagan, as with Volcker, was not inclined to tout the roaring stock market, but the market loved him. He was met with calls of “Eight More Years” and “Ronnie! Ronnie! Ronnie!”

If one watches the movies of 1980s Wall Street, and there are many, the story is usually of hard-scrabble outer-borough climbers who worked their way up to a glamorous Manhattan trading office. In Wall Street (1987), Charlie Sheen’s (real life and fictional) dad played a Queens-based airport mechanic who cautioned him against canny traders’ ways. Melanie Griffith commuted into Wall Street from big-haired Staten Island in Working Girl (1988). Danny DeVito, already in the flush of success, in Other People’s Money (1990) told his limo driver: “They’re not gonna send us back to the Bronx, Arthur.”

There was more than a hint of truth to these stories, but Hollywood was reluctant to note that most of these outer-borough risers in this decade were Jewish. Many followed the path of Saul Steinberg, a Brooklyn-born son of a small bathmat manufacturer who started the corporate takeover trend in the 1960s and then made it big in the 1980s. Carl Icahn was born in Brooklyn the son of two school teachers. His dad was a cantor at the local synagogue. Nelson Peltz was born in Brooklyn to a successful food distributor. Other of the biggest traders of the era came from beyond the boroughs: Michael Milken was the son of an accountant in Encino, California. Ronald Perelman was born in North Carolina to a successful paper products businessman. These men became the core of the corporate stock raiders that challenged corporate America’s WASPish ways.

With the exception of Icahn, who went to Princeton University across the Delaware River, every one of these attended the Wharton School of Business at the University of Pennsylvania, in part because UPenn had a reputation as being, unlike the other old Ivies, open to Jews. In the late 1960s about 40% of its student body was Jewish. Outsiders were attracted to Wharton, because, despite its academic qualities, Wharton remained something of a backwater. As one graduate remembered, Wharton in the 1960s “had these pale green cinderblock walls and vinyl tile floors.” It was an unpretty place that told people to look for value in unpretty things.

Given their backgrounds, it’s not surprising that what united these outsiders was a fascination with the undervalued. Although the anti-Semitism among their opponents was often palpable, their outsider perspective allowed them to look at firms, bonds, and stocks that weren’t glamorous but that contained within them the seeds of greatness. The great corporate battles these raiders led weren’t over the Apple Computers, but the cracker companies, lipstick companies, and beaten down airlines that others scorned.

Luckily, the raiders lived in a target-rich environment. In August 1982, the price-to-book ratio of the S&P 500, or how much the stocks were trading for on the market relative to their raw accounting value, was just about one. The Dow’s was 0.78. This meant that much of the American corporate sector would have its value improved by stripping it and selling it for parts. That’s exactly what many raiders tried to do.

The essential insight came from Michael Milken, who realized that although junk bonds looked risky individually, when you assembled a lot of them into a portfolio the risks canceled each other out and they turned into great investments. By issuing tons of junk bonds to eager investors, Milken and his allies could fund the takeover of almost whatever company they saw as undervalued. The junk bond buyers would get their high-interest loans paid back after everything was rejiggered or stripped and the stock purchasers paid off with the winnings.

It didn’t take a lot of insight into corporations to fuel takeovers, just guts and a willingness to upset old habits. Icahn told the head of Hammermill Paper Company that he wanted to “piece off the company.” He said “I’m only in this for the money. I don’t know anything about the paper business. I don’t care about the paper business.” With the book value so clear, almost any company could be bought up and parceled out.

The raiders helped fuel a mergers and acquisition boom. In 1985, almost 10 percent of the whole stock market was involved in a merger deal, a level five times that of the mid-1970s. The peculiar trade of the raiders was taking companies private. The number of companies taken private in raids and buy-outs peaked in 1988 at 2.5% of all stock market value. Instead of fighting the raids, Chairman Shad of the SEC argued that the takeovers forced corporate management to improve.

These mergers and threats of mergers did reform corporate America and helped propel the value of all stocks higher. A dollar invested in the S&P 500 right before the market’s bottom in August 1982 would be worth about triple in real terms by the same time in 1987, when it peaked. Although descriptions of Wall Street in the era focus on the stock boom, bonds were in a boom as well. In 1981 new public issues of bonds and notes besides U.S. Treasuries were less than $100 billion. Over the next 12 years they rose to well over $1.25 trillion. [Mallaby, More Money Than God, 186.]

The raiders made the biggest names of the era, but many stock pickers did well too. Warren Buffett had started his investment partnership in 1956, but it was only in the 1980s that he acquired popular prominence. Buffett also could function as a white knight protecting companies that were about to be taken over by raiders, as he did for the seller of World Book encyclopedias. Julian Roberston started Tiger Management in 1980, and his simple model, go long good companies and short bad ones in the same market, so that your yields were invariant to general trends, worked shockingly well. It helped that he focused on small stocks in an era when small stocks did great. Unlike the Nifty Fifty of the previous boom era, the whole market was rising.

For the first time Wall Street also brought academics into the mix. Fisher Black, of Black-Scholes fame, left academia to work at Goldman Sachs, recruited by future Treasury Secretary Robert Rubin. Richard Sandors, of inventing derivatives fame, went to Drexel with Milken. They brought new financial models and derivatives into mainstream trading.

The courtly Southern Paul Tudor Jones was one of the first traders to take advantage of these derivatives. He was the subject of a largely fawning documentary Trader that followed him in his work in 1986 The documentary showed him analyzing supposedly complicated mathematical models and then engaging in frantic phone shouting. But Jones worried about all the debt that had been “mortgaging our future earnings.” He made a prediction: “There will be some type of a decline, without a question, in the next ten to twenty months. And it will be Earth-shaking; it will be saber-rattling, and it will have Wall Street in a tizzy.”

The 1987 stock market crash, Black Monday, October 17th, seemed to many people to offer the perfect, if somewhat early, finale to the 1980s. As one news report on that day said, the crash was the result of “a nation living beyond its means.”

What really caused the crash remains open to debate. One of the causes was likely Alan Greenspan, the new chair of the Federal Reserve as of August. He was somewhat obsessed with the stock market (his dad had written a book in 1935 about a coming boom, which didn’t come) and he had harbored concerns throughout the 1980s that the market was flying too high. A few weeks after entering the office he engineered a somewhat devious interest rate increase, going behind the backs of the Federal Open Market Committee where rates were usually set. The increase was the first in 3 years and sparked concerns on the Street that the easy money was over. After the decision, he watched the stock market begin a steady drop. As his interlocutor Bob Woodward noted, “It was one of the most unusual experiences of his life,” watching a decision of his immediately move the market. Stocks moved downwards for the rest of September.

In October there was a larger than expected trade deficit that led some to be worried about the state of the dollar, which Treasury Secretary James Baker exacerbated by threatening to devalue the weekend before the crash. The problems were exacerbated by the fact that an Iranian missile hit a US oil tanker near Kuwait at the same time. This was part of the little remembered “tanker war” in the Gulf that threatened to blow up the recently quiescent oil markets again at any minute.

On the morning of Monday the 17th the Asian stock markets began dropping. Just before the US markets opened, some US naval destroyers lobbed shells at two Iranian oil platforms. Soon the sell orders came in so fast the stock ticker was an hour behind. While stocks were tumbling, the new SEC chairman David Ruder was misquoted as saying that the agency might close the market, further inflaming fears.

On Black Monday 1987, the Dow Jones dropped 22.6 percent. By comparison, on Black Monday October 28, 1929, the Dow Jones dropped less than 13 percent. People at the time noted the difference. “Percentage Decline is Far Steeper than ‘29” said the Wall Street Journal headline. It is still the biggest one-day decline in history.

It took almost 2 years for stocks to reach the level before the crash again. Junk bonds, which had powered the M&A boom that in turn powered the wider market, collapsed, never to regain full favor again. US Attorney Rudy Giuliani began jailing some of the top Wall Streeters. Just months before the crash, Ivan Boesky, who had famously told a group of students that “I think greed is healthy,” which transmogrified into the infamous line “Greed is good,” was sentenced to three years in prison for false reporting. Two years later Michael Milken was indicted and agreed to a plea deal.

The stock boom had ended in a crash, the top players were in jail, and everyone had the morality tale they wanted about a nation that had gone too far. For many, the end of a “decade of greed” was clear.

Yet most of what we know about the aftermath of the boom is wrong. Instead of 1987 representing the culmination of a sugar-high, it turned out to be a pause, caused by a series of one-off events, in the long march of stocks upwards. Instead of being the end of something, the eighties were the beginning of the modern long-term bull market. The economy after the 1987 crash continued to be vibrant. Those prognosticators, including Paul Tudor Jones, who predicted an imminent and catastrophic bear market, had to create ever more elaborate epicycles and abstruse explanations about why the Street was not just wrong for a year or a decade, but, now, for almost half a century.

The corporate raiders were a success. The price-to-book ratio of the S&P 500 was above two by the end of the decade, about double where it was earlier. Far from being the sign of excess animal spirits, the higher valuations were a sign of improved corporate governance. One study looked at the 62 biggest hostile takeover attempts from 1984 to 1986. While critics made a big deal of all the asset sales the raider conducted, which supposedly stripped the real value of such companies, the study shows these sales overwhelmingly went to firms in the same industry that could deploy the assets better. The real result was the “deconglomeration of American business and a return to corporate specialization” that led to higher returns. Despite claims that the raiders decimated blue-collar jobs, their layoffs “disproportionately affect high-level white-collar employees.” If anything, the main problem was that the raiders, at least in the latter half of the decade, overpaid and much of the benefits of their improvements went to the previous shareholders they bought out.

Most of the prosecutions of that era turned out to be flimsy. Milken only caved to a plea deal after prosecutors threatened to jail his brother. Rudolph Giuliani himself later said, “Milken and I are good friends now, and I believe Milken is an excellent candidate for a pardon.” Milken got his pardon n 2020. Much of the “insider trading” of the era involved people who were trading against themselves as much as anyone else. The claims that they were cheating their clients seem laughable when one considers the billions their clients made.

If the eighties were the “decade of greed,” as the New York Times still calls it, then Wall Street was the representative of everything that went wrong in those years. In reality, Wall Street was a great symbol of things going right. American outsiders challenged the old ways, got rich and in the process, made the country, and the world, better off. We should be so lucky to have another such era.

About the Author

Judge Glock is the director of research and a senior fellow at the Manhattan Institute and a contributing editor at City Journal. He can be found on X at: @judgeglock.